Rental Damage Protection (RDP) Option for Vacation Rental Owners

Rental Damage Protection (RDP) is an insurance product designed to provide an alternative/addition to managing refundable security deposits from guests while providing owners with property protection and peace of mind.

RDP is an insurance product designed by Protection Brands, in partnership with RentalGuardian® and InsureStays®, for vacation rental owners that are now available directly through your New York RBO dashboard. The RDP policy is by RentalGuardian. InsureStays is the insurance agency that backs all of the products.

Protecting your assets is extremely important when you own a vacation rental property. Keeping your property safe and protected from damage caused by guests is one of the most important aspects of being a property owner.

What is Rental Damage Protection?

RentalGuardian® provides an option for owners to offer a reasonably priced flat-fee damage policy. This insurance rids the owner of dealing with the hassle of collecting and refunding security deposits (not to mention the awkward conversation that comes with it). RDP helps to reduce your workload to save you time!

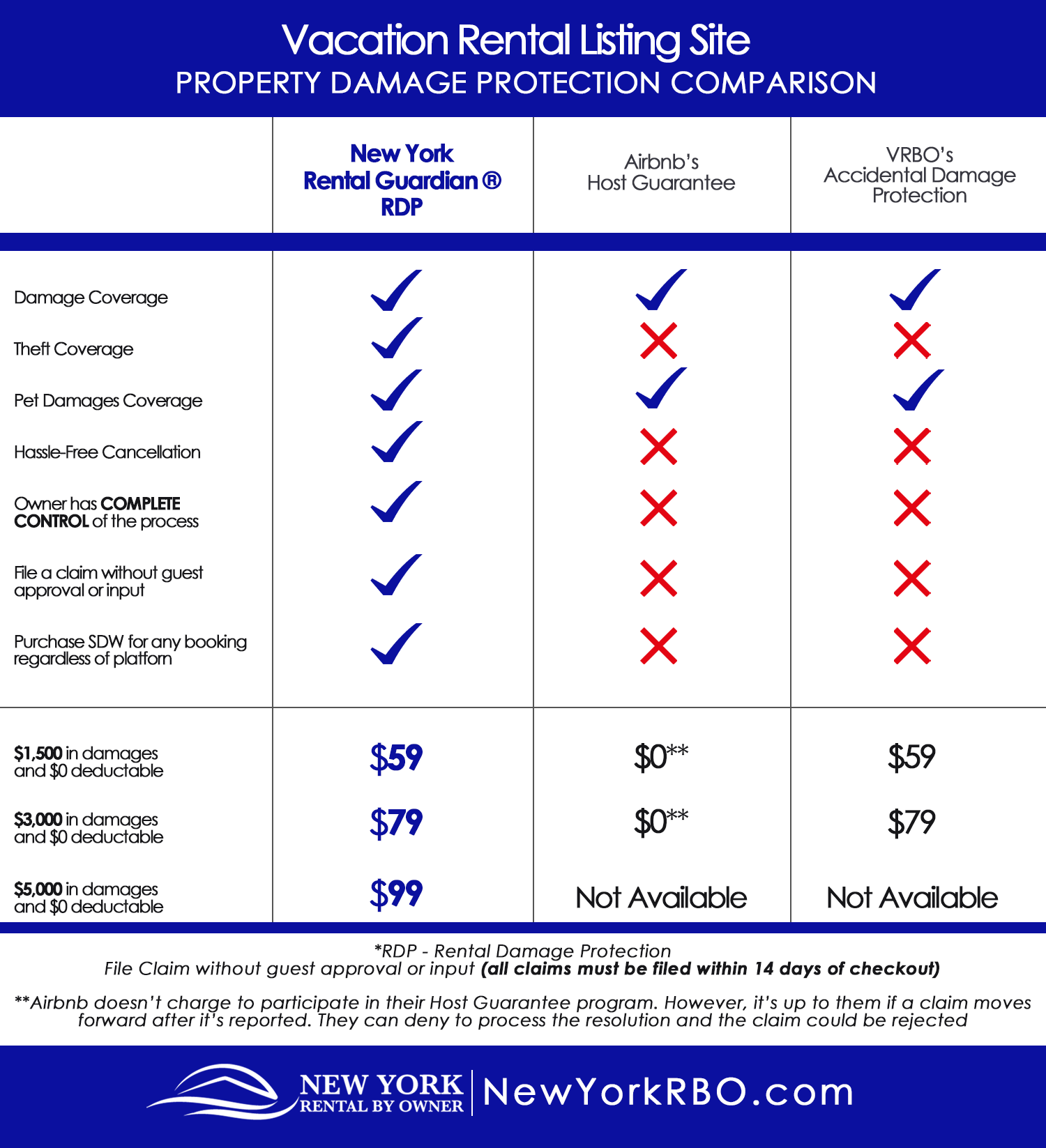

The Rental Damage Protection policy is a Tenant Legal Liability product created specifically for property owners and managers in case a guest causes damage or theft during a short-term rental stay. There are a few differences between Rental Guardian's insurance and other damage policies that many other booking platforms offer .

The biggest benefit is that the homeowner enrolls the guest (rather than the traveler) . This means that the owner has complete control over the entire process!

Rental Guardian eliminates the hassle of collecting and refunding security deposits from your guests, which also helps lower the cost to the guest when they are booking your property for their vacation! It won’t require them to have pre-authorized funds held.

Another great benefit to this Security Deposit Waiver is that the property owner is the primary claim initiator and claim beneficiary. There is no need to contact your guests in order for you to make a claim.

Here's how you can add Rental Damage Protection (RDP) to your Booking:

Let’s Talk Through Some Frequently Asked Questions (FAQ’s)

1. What’s Covered under the policy?

- "Unintentional" damage to furniture, appliances, decor, flooring, windows, and other interior items. Replacement costs of stained bedding, linens, and or lost keys are all covered. There is no coverage for smoking/vaping deodorization or excessive cleaning.

- Yes, theft is covered! There is only coverage of theft for any person other than the guest and their travel companions. RentalGuardian® does not cover intentional acts and coverage would not be afforded if the guest intentionally took something from the home, i.e. drinking glasses. You may need to file a claim with your homeowner's insurance or chalk it up to the cost of doing business.

- Pet damage is covered as long as the presence of the pet does not violate the rental agreement and your rental is pet-friendly.

2. What isn’t covered?

- Smoke Deodorization, including any smoke or vape scent removal.

- Excessive cleaning, or regular cleaning fees.

- Adverse weather (weather damage is typically covered by primary homeowner's insurance).

- Loss of income.

3. What are the policy costs to the owner and coverage?

Owners have the choice of two policies. The policy cost is per stay. Owners can choose to charge their guests the amount they choose.

- The $59 policy covers up to $1,500 in damages and a $0 deductible.

- The $79 policy covers up to $3,000 in damages and a $0 deductible.

- The $99 policy covers up to $5,000 in damages and a $0 deductible.

The expense/cost of the policy may be a business write-off to you. Please verify with your tax professional.

4. What do I, the owner, need to do?

This policy is for potential guests only and not for commercial events or parties. It is your job to ensure that you follow the policy guidelines. If you file a claim, you are responsible for submitting photos of the damage or theft, providing receipts and/or invoices for repairs, and a short summary of what happened.

If you claim more than $1,000 worth of damages police report is required.

5. How do I file a claim?

Log into your dashboard and select "Manage Bookings". Select the icon that says "File Claim" or click here.

Important Dates to Remember:

- 14 Days = claim must be opened from check-out

- 45 Days = to complete the claim

Claim Requirements:

- 1 = Photo of damage

- 1 = Paid receipt or paid invoice

- 1 = Description of damage and incident details

6. When does the coverage begin and when does it end?

This policy covers your property from the time the guest checks in to the time and date they check out.

7. How close to check-in can I purchase an RDP policy?

A new policy can be purchased up to 24 hours before check-in.

8. Can I use this policy to replace my homeowner's insurance policy?

No. This is a damage and theft policy only. It is best to keep your homeowner's insurance policy so you don’t have to submit a large number of small claims. Submitting a large number of insurance claims to your homeowner's insurance can hurt your CLUE (Comprehensive Loss Underwriting Exchange) report and the cost of an annual premium. We do not offer liability coverage .

9. Can I buy insurance when no one is renting my home?

No, the policy is based only on when you have guests staying on your property and not between rentals.

10. Why should I get short-term insurance as opposed to a year-long policy?

We know that when you run a vacation rental--you have a lot to think about. Between repairs/maintenance, cleaning, and guests coming and going, you don’t want to think about whether you’re covered or not. And who wants to pay for an insurance policy when there are no guests residing at your property? No one! We’re here to close the gap between expensive, full-time policies and your busy schedule.

11. How far in advance can I purchase a security deposit policy?

A Rental Damage Protection (RDP) policy can be purchased up to 24 hours prior to a guest checking in.

12. What happens if a renter cancels their stay?

No problem, simply log into your dashboard and cancel the desired insurance policy. Your payment will be refunded to you right away, it is that simple!

13. Don't have a New York Rental By Owner Listing?

You can still benefit from using our program and purchasing a security deposit policy. You just don't have the convenience of easily tracking it within the New York Rental By Owner dashboard.

It’s the most “vacation rental owner-friendly” insurance policy available today!

Here's how it compares to other popular vacation rental listing sites' insurance policies:

* The insurance products provided on the RentalGuardian® Platform and via their services are underwritten by a Lloyd's of London cover holder.